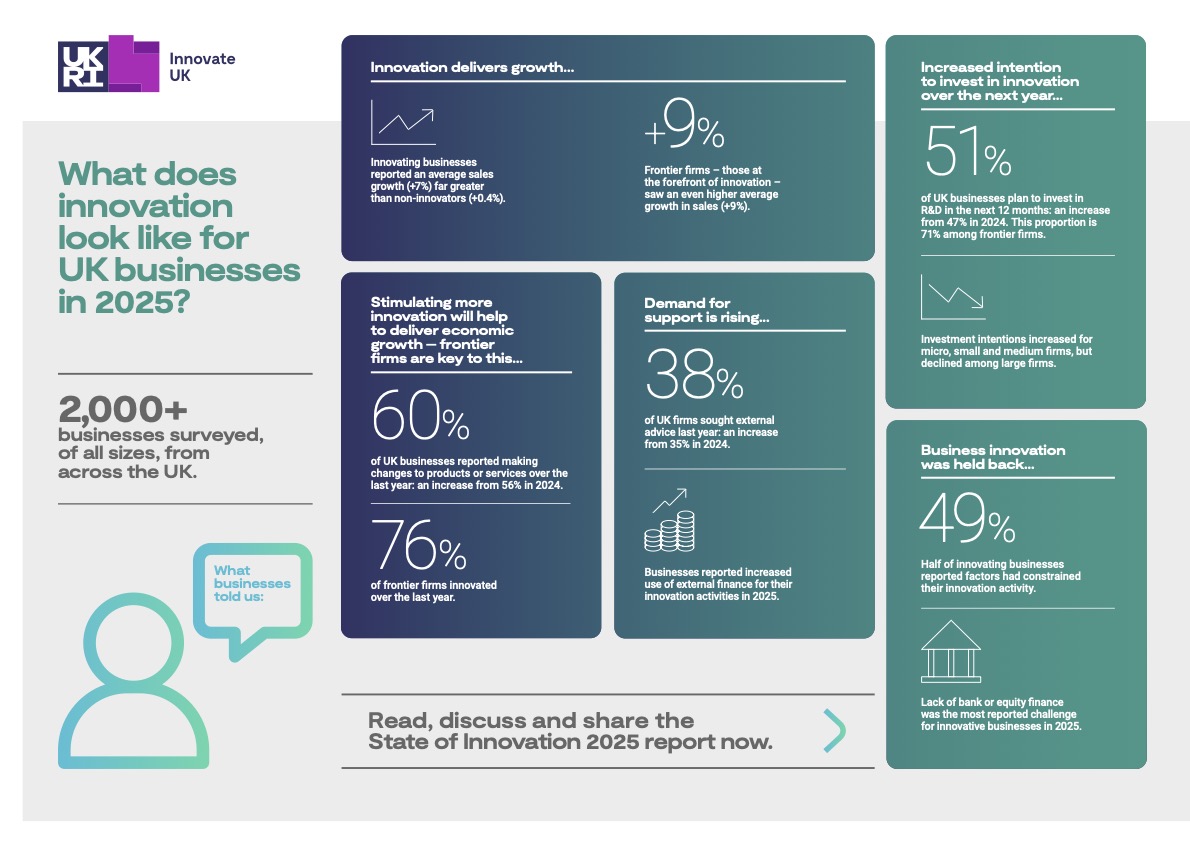

Innovative UK businesses reported markedly stronger sales growth than non-innovators in the past year, but access to finance remains the most commonly cited barrier to innovation, according to Innovate UK’s State of Innovation 2025 report, based on a survey of more than 2,000 firms.

The report found that innovating businesses reported average sales growth of 7% compared with 0.4% for non-innovators. ‘Frontier firms’ – defined in the survey as businesses that strongly agree they are often the first to introduce innovative products or services relative to UK competitors – reported average sales growth of 9%.

For robotics, automation and industrial technology suppliers, the findings point to continued demand for productivity-focused solutions, but also a more constrained investment environment for many customers.

Nearly half (49%) of innovating businesses said barriers had constrained their innovation activity in 2025, up from 44% the year before. Among innovators reporting barriers, 74% cited a lack of bank or equity finance as the most significant challenge, alongside uncertain demand (50%) and regulation or standards (50%).

Innovate UK’s survey also indicates rising innovation activity in some areas, with 60% of UK businesses reporting changes to products or services over the last year, up from 56% in 2024.

Frontier firms reported higher levels of innovation activity, with 76% innovating over the last year, up from 68% the previous year. At the same time, the report notes that firms appear to be concentrating efforts across fewer types of innovation on average, with the average number of innovation types undertaken falling from 2.3 in 2023 to 2.1 in 2025.

The report links innovation with operational outcomes that are directly relevant to automation and digital transformation programmes. Among businesses that reported process innovation over the previous 12 months, 63% said it delivered cost savings, while 18% reported increased costs and 17% reported no change. Of those reporting savings, more than half (56%) said the savings were at least 10%.

On investment signals, just over half (51%) of UK firms said they plan to invest in R&D over the next 12 months, up from 47% in 2024. Among frontier firms, the proportion planning to invest in R&D was 71%. The report adds that investment intention increased among micro, small and medium-sized businesses, while large firms showed a decrease in expected investment.

Beyond R&D, 54% of firms reported purchasing machinery, equipment or software over the last year, which the report describes as the most common type of innovation-related investment. Businesses also reported increased use of external finance for innovation activity, with grants, government loans, bank loans and equity finance all rising between 2023 and 2025.

Demand for external support also increased. The proportion of firms seeking external advice rose to 38% in 2025 from 35% in 2024, with the most commonly sought advice still focused on business growth strategy.

However, Innovate UK reported a rising trend in firms seeking advice on digital technologies, product or service innovation and net zero and reducing environmental impact. Collaboration for innovation also increased, with 42% of firms reporting collaboration with other organisations, up from 39% in 2024.

Dan Hodges, deputy director of strategy at Innovate UK, said the survey “sends a clear message that innovation is crucial” to faster UK growth, while warning that friction around funding, resources and advice can prevent firms turning intention into outcomes.

The State of Innovation 2025 summary report draws on the Innovation State of the Nation Survey, conducted between March and July 2025 with 2,020 respondents across UK regions, sectors and firm sizes, focusing primarily on innovation activity in the previous year.

Join 400 exhibitors and 11,000 industry leaders at Robotics and Automation Exhibition on 18-19 March 2026 at NEC Birmingham to explore cutting-edge technologies, connect with peers and discover the latest innovations shaping the future of manufacturing, engineering and logistics.